NOTE: This post includes data first shared on-stage during Front Office Sports Tuned In Conference on September 16, 2025

The sports media landscape has long been intertwined with the linear television business model. However, in recent years, marquee live sports events have become available on streaming services, in addition to their linear broadcasts. Live sports on ESPN and Fox were exceptions, as their sports programming was largely unavailable to streaming-only households. That changed with the launch of the ESPN and FOX One streaming services, both on August 21st, just in time for the start of the NFL season.

Early data from Antenna suggests this new era is off to a solid start for both services.

Antenna estimates approximately 1M Sign-ups to ESPN or FOX One between their launches on August 21 and August 31, 2025. It’s important to note that this topline data does not include existing Disney Bundle subscribers who had access to ESPN+ and now get access to ESPN Select, or those who activated the service through an MVPD (Multichannel Video Programming Distributor) partnership. Additionally, both services’ NFL bumps likely hit closer to their first regular season games, which started on September 7.

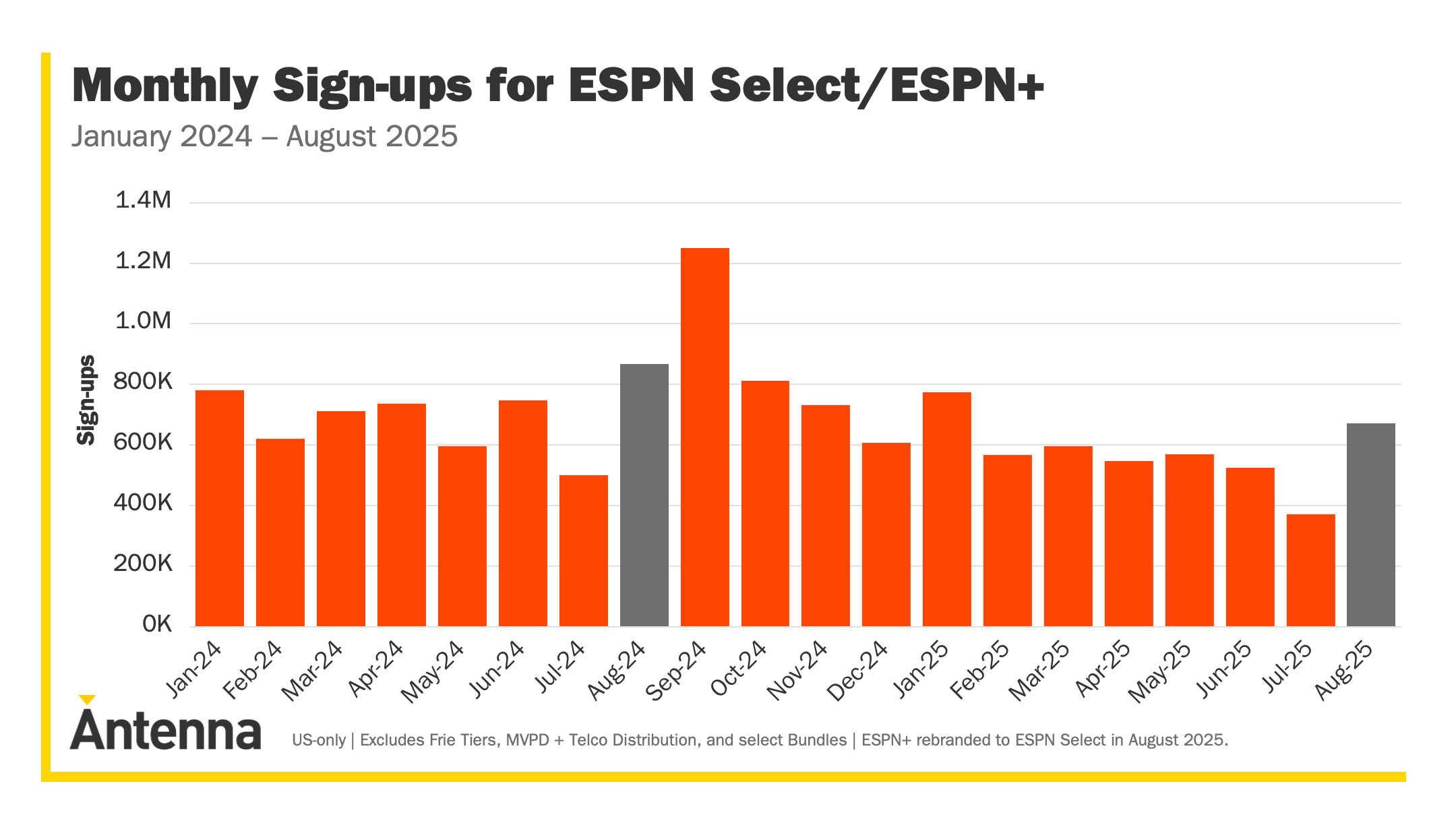

While much of the buzz has been around the new flagship offering, ESPN's legacy streaming service, now known as ESPN Select (formerly ESPN+), has shown impressive resilience. In a testament to its standalone value proposition, Antenna observed only a 25% decrease in dedicated sign-ups for ESPN Select in August 2025 compared to the same period the previous year, despite ESPN Select access being included in the package for all ESPN Unlimited subscribers.

Disney continues to show strength in bundling, as Antenna observed that 4 in 5 Sign-ups for the new premium service, ESPN Unlimited, between August 21 and 31 came through a bundle.

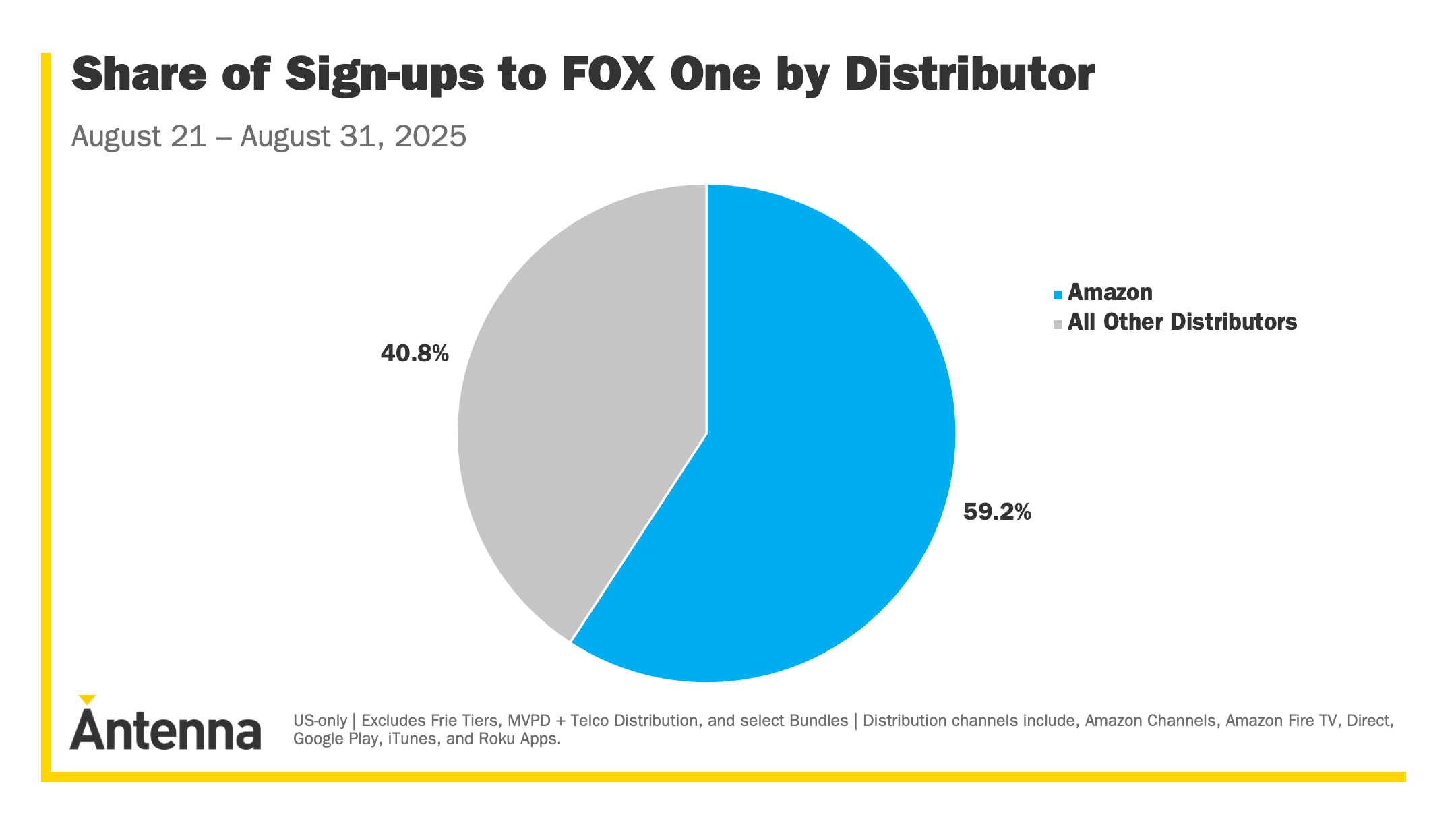

For Fox, its distribution partnership with Amazon is already paying dividends. Antenna estimates that almost 60% of all sign-ups to FOX One between August 21 and 31 came via an Amazon-distributed channel.

While these early returns are strong, they are still just that—early. We will keep a close eye on the progress of these services as we observe the impact of major fall events, such as the NFL and World Series playoffs.

For more detailed information on Antenna’s methodology and definitions of core metrics, please visit http://www.antenna.live/methodology.

This post has been updated as of October 9, 2025.

.png)